By Rubendran Sathupathy

Faculty of Business and Communications at INTI International University organized the symposium “Current Trends in Quantitative Methods and its Applications” on 28th October, to provide an understanding of quantitative methods in several key areas and their findings.

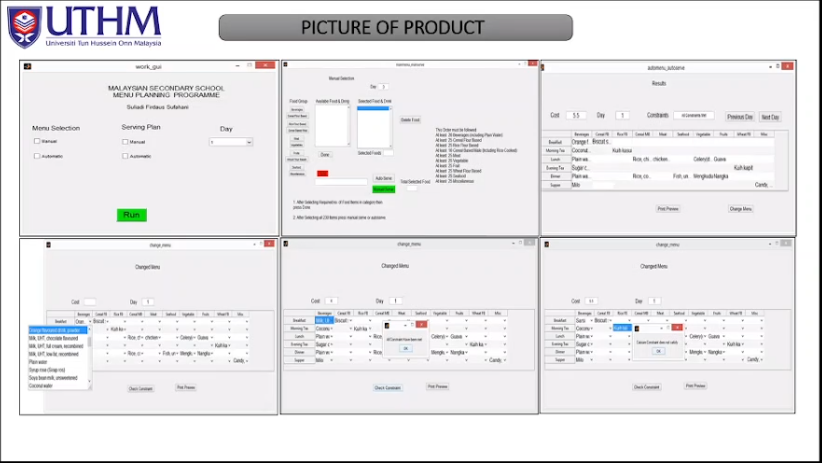

The first presenter, Associate Professor Ts. Dr. Suliadi Firdaus bin Sufahani, Associate Professor at Universiti Tun Hussein Onn, Malaysia, discussed the “Optimization Technique with Sufahani-Ismail Algorithm for School Children Healthcare.”

“We wanted to find out whether caterers could prepare six healthy meals a day (breakfast, morning tea, lunch, evening tea, dinner, and supper) for hostel students within a certain budget (RM 15 per student) using a mathematical formula,” said Dr. Suliadi.

“Previously, caterers used the “matchbox method” which consists of a little bit of everything (rice, vegetables, meat). However, this did not fulfill the students’ nutritional requirements. Students also grew bored with the lack of variety of food.”

Dr. Suliadi and his team solved this problem by developing an algorithm using a combination of linear and binary programming based on nutritional levels. They fed the converted dataset into the system.

He said the system can automatically generate seven healthy meals a day for students with variety and within budget.

“It also resulted in 52.24% savings for caterers which equals to more than RM ¼ billion government savings per year,” he said.

Meanwhile, Dr. Hamad Raza, Assistant Professor at Government College University, Faisalabad, Pakistan, examined “Sectorial Analysis of Multi-Level Determinants Influencing Stock Price of Non-Financial Listed Firms in Pakistan.”

“Stock price is the maximum amount someone is willing to pay for a share or stock of a firm,” explained Dr. Hamad. “It is important to determine the trend of movements in the capital market and procure investment in equity shares.”

His study aspired to track share prices across three different sectors in Pakistan, namely: sector-level factors (i.e., industry concentration), firm-level factors (i.e., financial sustainability), and country-level factors (i.e., political instability).

As to why he chose Pakistan specifically, he said that Pakistan has experienced all three factors previously.

“We found that all firm-level, partially sector-level, and country-level determinants are significant. There is a mixed trend across sectors,” he concluded.

Dr. Hamad added that the study has multiple implications for the industry and several key parties such as the firm’s management, regulators, and policymakers.

“For example, for firms in industries, this study highlights the important factors through which they can control and improve their firms’ share price across sectors. The findings can also help financial analysts to hierarchically identify the reasons for share price movement.

“Additionally, the study points out the factors that investors should consider before investing in the firms’ stocks.”

Besides, Dr. Jayeola Dare, Senior Lecturer at Adekunle Ajasin University, Nigeria, analyzed the “Optimal Method of Investing on Assets using Black Litterman Model.”

“The Black Litterman Model is based on diversification,” described Dr. Jayeola. “Diversification is the process of investing in as many assets as possible to minimize risk and maximize profit.”